A Study on Contactless Payments by Country

Clearly Payments

SEPTEMBER 16, 2024

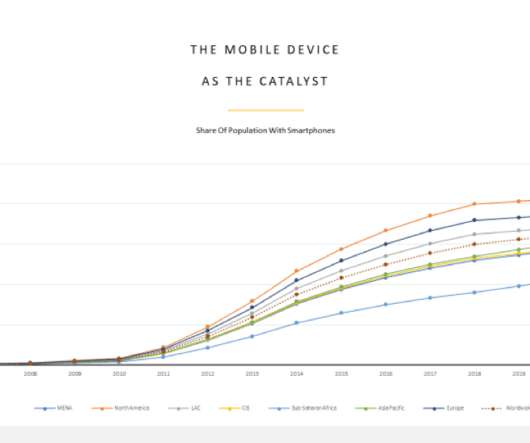

As digital infrastructure continues to advance, the ease and speed of contactless transactions are becoming increasingly attractive to consumers and businesses. Instead of entering a PIN or handling cash, users can simply tap their card or mobile device to complete a transaction in seconds. What are Contactless Payments?

Let's personalize your content