NY governor pursues BNPL regulation

Payments Dive

JANUARY 3, 2024

Kathy Hochul is seeking to require buy now, pay later providers to obtain a license to operate in the state, in addition to other potential regulations for the industry. New York Gov.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Regulations Related Topics

Regulations Related Topics

Payments Dive

JANUARY 3, 2024

Kathy Hochul is seeking to require buy now, pay later providers to obtain a license to operate in the state, in addition to other potential regulations for the industry. New York Gov.

Payments Dive

SEPTEMBER 19, 2023

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

The Fintech Times

NOVEMBER 27, 2024

While the FCA still warns that consumers who invest in cryptoassets ‘should be prepared’ to lose all of their money, due to the continuing volatility and lack of regulation surrounding the industry, consumers appear undeterred. In fact, the FCA noted a rise in the average value of crypto held by people from £1,595 to £1,842.

Fintech News

SEPTEMBER 2, 2024

As data privacy regulations tighten across APAC, driven by growing digital transformation and increased awareness of privacy concerns, Sumsub’s LDP solution aims to help businesses navigate these evolving requirements. LDP simplifies compliance with these local regulations by ensuring data is stored and processed locally.

The Payments Association

FEBRUARY 14, 2024

How regulatory reforms and increased capital can drive UK fintech expansion Read more

The Payments Association

DECEMBER 2, 2024

2024 reshaped payments with instant payment mandates, crypto regulations, and enhanced consumer protection driving innovation and security. In 2024, payments regulation underwent seismic shifts, with reforms spanning fraud prevention, digital innovation, and consumer protection, collectively redefining the industry’s future.

Fintech News

SEPTEMBER 17, 2024

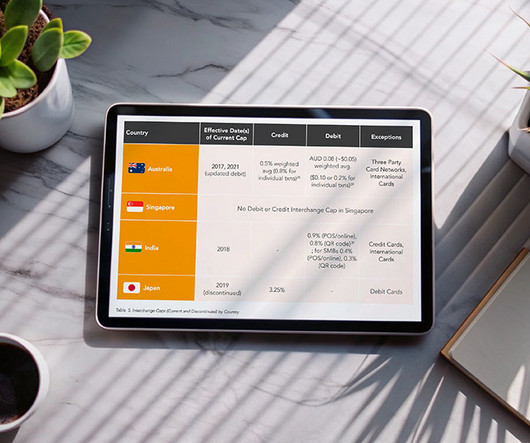

A new report by CMSPI, an American payment consultancy, produced in collaboration with Amazon, explores payment trends and regulations in Asia-Pacific (APAC), focusing on the impact of rising card fees on merchants and the regulatory responses to these challenges. billion transactions in 2023, representing a year-over-year growth of 42.2%.

Fintech News

SEPTEMBER 9, 2024

Featured image credit: Edited from Freepik The post Indonesian Regulator Grants Binance-Backed Tokocrypto Trading License appeared first on Fintech Singapore. .” In December 2022, Binance had acquired Tokocrypto and conducted mass layoffs with approximately 58% of its workforce being let go.

The Payments Association

OCTOBER 30, 2024

Compliance in payment communications is essential for trust and security; AI-driven solutions and customised frameworks help businesses meet regional regulations, ensuring secure global operations. Ensuring that communications comply with global regulations is essential for protecting a business’s reputation and operations.

Finextra

OCTOBER 22, 2024

Regulators must define a “minimum set of data” to be shared between banks that would still “serve the purpose” of fraud detection and prevention, said Michele Gentile, head of group correspondent banking, APAC, UniCredit, at Sibos today.

Fintech Finance

OCTOBER 17, 2024

” The launch of Broadridge’s Instant Payments service aligns with recent EU regulations mandating the facilitation of euro instant credit transfers. These regulations are expected to accelerate the adoption of instant payments across Europe, with key compliance deadlines set for 2025.

Fintech Finance

DECEMBER 3, 2024

PayRetailers , a leading payment processor in Latin America and Africa, has launched an enhanced Pix payment solution to assist betting operators in Brazil as they prepare for the new sports betting regulations set to take effect on 1 January 2025.

Fintech News

DECEMBER 16, 2024

The event is expected to bring together leading regulators, fintech executives, banks, and industry disruptors from across the Asia-Pacific region to discuss trends and innovations shaping the financial sector, with a focus on real-world case studies and actionable strategies.

Fintech Finance

OCTOBER 23, 2024

Led by Intix, the survey explored readiness levels and compliance with key regulations, including ISO 20022 standards, as well as the readiness of banks as they prepare to meet the EU’s Instant Payments Regulation, which takes effect in January 2025 for receiving instant payment transactions and October 2025 for sending instant payment transactions.

Fintech News

NOVEMBER 10, 2024

With a focus on Singapore, QCP Trading plans to expand its local team and attract top talent to support its growth and ensure compliance with local regulations. Darius Sit “As we pursue the full MPI license, we remain focused on supporting Singapore’s growing reputation as a leader in digital asset regulation.

Fintech Finance

OCTOBER 24, 2024

As the government plans to regulate buy now pay later firms by 2026, more than one in ten millennials (13%) and Gen Z (11%) consumers plan to put Christmas on credit using buy now pay later apps*, RSM UK’s latest Consumer Outlook reveals. RSM UK recommends providers take the following steps to prepare for the new regulation.

The Fintech Times

DECEMBER 9, 2024

The post Google Hits Back at US Regulator Over Payment Arm Supervision appeared first on The Fintech Times. The agency began using its dormant oversight powers after a 2022 assessment found gaps in its supervisory programme. Companies notified of supervision can either accept the designation or contest it, as Google has done.

Payments Dive

MARCH 4, 2024

Federal regulators reviewing whistleblower allegations related to Block’s Cash App may act on the complaints this year, predicted an attorney for the complainants.

Finextra

DECEMBER 16, 2024

The UK's Financial Conduct Authority has set out its latest steps to improve the integrity of the UK's crypto market.

Payments Dive

SEPTEMBER 8, 2023

“Regulations imposed by Big Tech firms have a big impact on whether consumers and businesses can make payments using third-party apps,” CFPB Director Rohit Chopra said in a Thursday press release.

Fintech News

DECEMBER 5, 2024

Coinbase plans to hire country leaders in Thailand and the Philippines to coordinate with developers, regulators, and content creators, fostering innovation and adoption of blockchain-based solutions. This was enabled through Rubie , a baht stablecoin wallet developed by Siam Commercial Bank (SCB) in collaboration with Base.

Payments Dive

OCTOBER 24, 2024

Regulators and industry participants worry that FDX will have an unfair monopoly and will advantage its own members if no other organization applies.

Payments Dive

NOVEMBER 13, 2023

The EU would require big tech companies, like Apple and Google, to offer their customers payment services through the new digital identity wallet if the regulation is approved.

Fintech Finance

AUGUST 27, 2024

the innovative, tech-driven payments bank, announces the launch of EURI, a bank-backed stablecoin, compliant with the Markets in Crypto Assets Regulation (MiCA). The launch of EURI follows the implementation of the first phase of the MiCA regulation which applies to asset referenced tokens and e-money tokens from the 30 June 2024.

Open Banking Excellence

JULY 1, 2024

Open Banking in a Box, a new programme from Open Banking Excellence (OBE) , is leveraging the UK’s position as the world leader in open banking to help regulators globally develop their own open banking markets. This provides the building blocks for regulators globally to drive transformational change in their own countries.

The Fintech Times

JUNE 29, 2024

The first stage of the European Union ‘s Markets in Crypto Assets Regulation (MiCA) will come into play on 30 June. In terms of market surveillance, the MiCA regulation is based upon requirements set out in the EU’s Market Abuse Regulation (MAR).

Open Banking Excellence

JULY 9, 2024

In my conversations with Open Banking Excellence, it is clear to me that by sharing the Kazakh experience and journey with regulators and the like, we can learn from each other to promote the digital economies of all of our countries. Regulator-led Pilot Focused on Open API Infrastructure Our pilot launched on Nov.

Fintech News

DECEMBER 3, 2024

The Telecommunication Regulator of Cambodia (TRC) implemented this action due to the platforms’ lack of necessary licensing from the Securities and Exchange Regulator of Cambodia (SERC).

VISTA InfoSec

OCTOBER 21, 2024

A data protection officer role is to act as a bridge between organizations, its employee, and the regulatory authorities ensuring that the handling of personal data is safe, lawful and in line with regulations like GDPR (General Data Protection Regulation). Additional Responsibilities of DPO (As seen in other Regulations) 1.

The Payments Association

SEPTEMBER 17, 2024

With the rollout of new instant payment regulations under the SEPA Instant Credit Transfer (ICT) scheme, Europe’s cross-border payments landscape is significantly transforming. From overhauling existing systems to adjusting sanctions screening processes, firms need to navigate these complexities to stay compliant and competitive. Read more

Finextra

DECEMBER 16, 2024

The Australian Securities and Investment Commission (Asic) is suing HSBC for failing to adequately protect customers scammed out of millions of dollars.

Open Banking Excellence

MAY 23, 2024

Following this announcement, the Konsentus Q1 2024 TPP tracker has revealed an overall growth in the European third parties that are regulated to provide Open Banking services around their domestic market, as well as an overall increase in TPPs authorised to initiate payments and transactions on an account holder’s behalf.

Fintech News

SEPTEMBER 11, 2024

Swift, the global financial messaging network, is actively working to incorporate regulated digital assets and currencies onto its platform. In a broader push for global interoperability, Swift is exploring ways to connect emerging bank-led networks, such as the US Regulated Settlement Network, with other financial infrastructure.

Payments Dive

MAY 23, 2024

This week, South Carolina became the fifth state to enact a law regulating earned wage access providers, but it doesn’t subject them to lending laws.

The Payments Association

NOVEMBER 28, 2024

PSD3 builds on PSD2 by clarifying regulations, expanding bank liability, and introducing stricter IT and risk standards. The PSR (Payment Service Regulation) complements the Payment Service Directive, leading to directly applicable law in all EU states. PSD3 and PSR are the latest initiatives driving these goals. What are PSD3 and PSR?

Stax

DECEMBER 20, 2023

Please note there are many other categories not covered in this table, including variations by card type, business type, whether the bank is regulated or exempt, and more. Beyond the card type (debit, or the various kinds of credit cards), you’ll also see “exempt” or “regulated” which indicate different fees for debit cards.

The Fintech Times

APRIL 17, 2024

The UK’s Regulated Liability Network has chosen R3 , a company specialising in enterprise distributed ledger technology and services, as well as Quant , a blockchain provider for finance, to develop the technology prototype for its experimental stage.

Finextra

NOVEMBER 12, 2024

UK financial regulators have confirmed new rules to bolster the resilience of technology and other third parties providing key services to financial firms.

The Fintech Times

MAY 26, 2024

A key part of open banking is regulated third-party providers (TPP). In September 2019, Konsentus started reporting on the number of regulated open banking third parties in the European Economic Area (EEA). They act as intermediaries between the bank and the customer.

VISTA InfoSec

JUNE 3, 2024

If your company has ever worked with businesses in European Union countries, you probably had to follow the EU’s General Data Protection Regulation (GDPR). Compliance with Other Standards and Regulations While GDPR sets a high bar for data protection, organizations must also consider compliance with other relevant standards and regulations.

Finextra

NOVEMBER 22, 2024

To mark International Fraud Awareness Week, Payments System Regulator (PSR) has released research on the impact of Authorised Push Payment (APP) fraud on UK consumers.

VISTA InfoSec

OCTOBER 21, 2024

Their key responsibilities as per article 39 of GDPR include: Guiding the controller, processor, and employees on their data protection obligations under relevant regulations, such as GDPR, CCPA, and others. Strong communication skills to easily convey technical and legal concepts to the stakeholders, regulators, and employees.

Fintech News

AUGUST 12, 2024

This approval follows an in-principle nod received earlier this year and allows BitGo to offer regulated digital payment token services in Singapore. Clients can now access deep liquidity and leverage BitGo’s advanced platform for trading and custody in a regulated environment.

Open Banking Excellence

SEPTEMBER 27, 2024

Half a decade ago, Mexico demonstrated its ongoing commitment to updating its financial regulation with the introduction of the Fintech Law. Other important data to consider: Regulators Open Banking Opportunities In Mexico Our optimism for Mexico’s potential is boundless. of households, while Internet penetration is 62.9%.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content