RTP takes on FedNow

Payments Dive

JULY 31, 2023

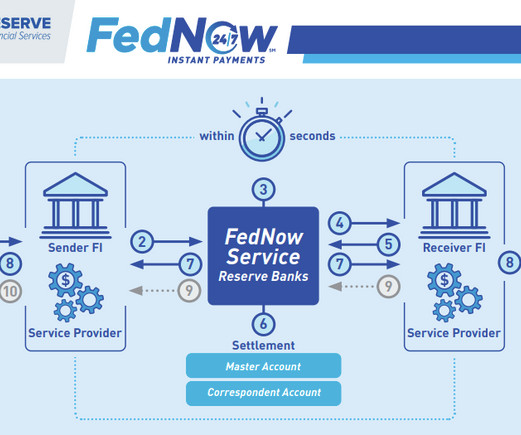

the rivalry between RTP and FedNow could get intense, but maybe not. As the only two real-time payments rails in the U.S.,

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

RTP Related Topics

RTP Related Topics

Payments Dive

JULY 31, 2023

the rivalry between RTP and FedNow could get intense, but maybe not. As the only two real-time payments rails in the U.S.,

Payments Dive

JULY 16, 2024

The Federal Reserve’s nascent instant payments system has collected hundreds of bank participants across the country in its first year of operations, although a few major banks are holdouts.

Finextra

APRIL 4, 2024

Consumers and businesses took advantage of instant payments through The Clearing House RTP network, which resulted in numerous records set in the first quarter of 2024.

Fintech Finance

DECEMBER 5, 2024

The Clearing House , the operator of the RTP® network, the largest instant payments system in the United States, will raise the individual transaction limit to $10 million. The RTP transaction limit has been $1 million since April 2022, when the limit was increased from $100,000. In October, the RTP network experienced a record 31.9

Bank Automation

DECEMBER 6, 2024

The Clearing House (TCH) expects to see growth in volume and use cases, Jim Colassano, senior vice president of product development at TCH, told Bank Automation […] The post The Clearing House raises RTP transaction limit to $10M appeared first on Bank Automation News.

Finextra

JULY 10, 2024

Consumers and businesses sent $1 billion in instant payments on June 28 over the RTP® network, a single day record for the largest instant payments system in the United States, operated by The Clearing House.

PYMNTS

SEPTEMBER 15, 2020

PYMNTS examines the latest initiatives that look to improve upon existing rails, or embrace new ones like blockchain and RTP. RTP Expands Across FI Base. are increasingly linking into the real-time payments infrastructure of the RTP network, according to a new survey by The Clearing House.

Fintech Finance

JULY 10, 2024

Consumers and businesses sent $1 billion in instant payments on June 28 over the RTP® network, a single day record for the largest instant payments system in the United States, operated by The Clearing House. This record setting quarter continues an impressive trend for the RTP network, which previously set numerous records in Q1 2024.

Fintech Finance

NOVEMBER 12, 2024

The RTP® network, the largest instant payments system in the United States operated by The Clearing House , now averages over 1 million payments per day. The RTP network also set single day records of 1.46 In October, the RTP network experienced a record 31.7 In October, the RTP network experienced a record 31.7

Faster Payments Council

SEPTEMBER 6, 2024

Is your financial institution fully harnessing the potential of RTP® and FedNow® to drive growth? Join us for an upcoming FPC webinar, sponsored by Finzly, on Wednesday, September 18 from 12:00pm-1:00pmET.

PYMNTS

JUNE 21, 2020

Virginia’s Chesapeake Bank has joined The Clearing House’s Real-Time Payments (RTP) network, showing that smaller community banks have joined the new trend of enabling instantaneous payments and receipts for customers, a press release said. ” The Clearing House’s RTP network is available for any federally insured U.S.

Faster Payments Council

AUGUST 23, 2024

Is your financial institution fully harnessing the potential of RTP® and FedNow® to drive growth? Join us for an upcoming FPC webinar, sponsored by Finzly, on Wednesday, September 18 from 12:00pm-1:00pmET.

Faster Payments Council

MAY 17, 2021

Introduction on RTP and its adoption around the world. While real-time payments (RTP) was previously considered an infrastructure luxury, it has now become a common method of payment in many parts of the world. Digital and RTP payments have dramatically accelerated the pre-existing, but slow-moving trend, away from cash and checks.

Faster Payments Council

AUGUST 16, 2024

Is your financial institution fully harnessing the potential of RTP® and FedNow® to drive growth? Join us for an upcoming FPC webinar, sponsored by Finzly, on Wednesday, September 18 from 12:00pm-1:00pmET.

Fintech Finance

JULY 30, 2024

AppBrilliance , a pioneer in real-time payment solutions with its cutting-edge Money API platform, is leveraging a recent rule change by The Clearing House to expand use-cases for Real Time Payments (RTP) to closed-loop digital wallets in the US.

PYMNTS

AUGUST 20, 2020

New research says businesses are eager to make the leap into real-time payments (RTP) — and to embrace new payment rails in their effort. Businesses Ready To Jump Into RTP. A new survey from Citizens Bank says businesses are jumping into the real-time payments opportunity. Faster Payments Council Announces Board Advisory Group.

Bank Automation

JANUARY 24, 2024

Mastercard will be the exclusive instant payments software provider for The Clearing House’s (TCH) RTP network, according to a news release from Mastercard. TCH’s RTP network has been gaining traction since the launch of FedNow, with more […]

Bank Automation

MAY 24, 2024

The Real Time Payments (RTP) network has completed 750 million transactions since its launch in 2017, although network growth didn’t start to tick up until 2021, Jim Colassano, […]

PYMNTS

JUNE 18, 2019

In recent months, though, real-time payments (RTP) have garnered more interest and no shortage of headlines in the U.S. The Clearing House [TCH] launched its own RTP network at the end of 2017.). Cheney told PYMNTS that several factors underpin the readiness for that shift toward RTP. RTP And RFP.

Bank Automation

NOVEMBER 30, 2023

Financial institutions may consider which payment rails to integrate — whether RTP or FedNow — but the right answer might be both. “I recommend to financial institutions that if they’re going to just receive, do both rails,” Jeff Bucher, senior product manager for money movement solutions at Alkami Technology, tells Bank Automation News on […] (..)

Bank Automation

MAY 13, 2024

The RTP network has more than 500 institutions on its network, according to The Clearing House’s website. Adoption is ticking up for The Clearing House’ Real Time Payments network and the Federal Reserve’s FedNow payments rail as financial institutions add payment services to their platforms.

Bank Automation

MAY 6, 2024

Businesses prefer The Clearing House’s RTP solution because it is established and is used by nearly 67% of U.S. The Clearing House’s Real Time Payments’ network is gaining mid-market companies as businesses gravitate toward real-time payments.

Payments Dive

DECEMBER 13, 2023

The number of banks participating in The Clearing House’s real-time payments network surged this year after the launch of the rival FedNow system.

PYMNTS

NOVEMBER 18, 2020

The Clearing House 's RTP network is now several years old, and while the real-time payments capability is gaining traction, adoption in the B2B landscape remains muted. The global pandemic has led to an increase in RTP adoption, as businesses find themselves unable to get to the office to print and send paper checks.

Bank Automation

DECEMBER 20, 2023

The Clearing […]

PYMNTS

JANUARY 8, 2021

In short, the global pandemic has ushered in rising usage — and use cases — for TCH’s RTP ® network, and Whisler doesn’t see that slowing down anytime soon. We've seen a lot of excitement this year with the RTP ® network, and we're very much expecting next year to grow even faster,” she said. Becoming A 24/7 RTP Shop.

Payments Dive

NOVEMBER 14, 2023

The new hire is tasked with boosting adoption of The Clearing House’s RTP real-time payments system, as the new rival Federal Reserve FedNow system seeks to attract clients.

The Paypers

SEPTEMBER 11, 2024

First Citizens Bank has announced that its business and consumer banking customers can now instantly receive payments into their savings and checking accounts through the national RTP network.

PYMNTS

AUGUST 10, 2020

These efforts include TCH’s efforts to connect financial institutions’ (FIs’) core banking systems to the company’s Real-Time Payments (RTP) network, along with what card networks and FinTechs are doing to enable real-time push payments to receiver bank accounts. New Trends Emerging. Achieving ubiquity across the 12,000 or so FIs in the U.S.

PYMNTS

MARCH 9, 2020

Banking association and payments company The Clearing House (TCH) has been confronting such concerns as it advances its real-time payment ( RTP ) offering in the U.S., The federal government deliberated in 2018 and 2019 over developing its own real-time payment system, FedNow , to compete with RTP.

PYMNTS

DECEMBER 24, 2020

This interest notably appears to be translating into action as more than 85 percent of firms are either in the process of implementing RTP or expect to do so within the next three years. RTP is particularly relevant in the current climate. PYMNTS research from January found that 66.7 A November survey from PYMNTS showed that 44.7

Fintech Finance

JUNE 25, 2024

headquartered in Texas, to deliver instant payments capabilities to the banks global business and consumer customers through the Federal Reserve’s FedNow® and The Clearing House’s RTP®. The post Frost Bank Taps Finzly to Provide FedNow and RTP Instant Payments to its Business Clients and Consumers appeared first on Fintech Finance.

Finextra

JUNE 25, 2024

headquartered in Texas, to deliver instant payments capabilities to the banks global business and consumer customers through the Federal Reserve’s FedNow and The Clearing House’s RTP®. (“Finzly”), a leader in innovative payment and financial solutions, today announced a partnership with Frost Bank, a subsidiary of Cullen/Frost Bankers, Inc.

Payments Dive

JANUARY 29, 2024

The extended partnership between the two companies “focuses on co-development of new real-time payments capabilities,” a spokesperson for The Clearing House said.

PYMNTS

JANUARY 11, 2021

PYMNTS' latest Real-Time Payments Report done in collaboration with The Clearing House looks at the matter through numerous use cases, none more informative than that of New Jersey-based community bank Cross River , with its enthusiastic embrace of real-time payments (RTP). Yet banks and FIs are making the move to RTP.

PYMNTS

JANUARY 14, 2021

The Clearing House's real-time payments offering, the RTP ® network, continues to gather steam with financial institutions (FIs), FinTechs and their business customers in this week's Payment Rail Innovation roundup. Wells River Savings Bank Joins The RTP Network. Wells River Savings Bank Joins The RTP Network.

Tearsheet

FEBRUARY 16, 2024

“Beyond extending our partnership with Mastercard, we intend to partner on innovating for the banks that use the network by looking for additional use cases that they’ve expressed interest in and that would help drive volume across RTP,” said Lee Alexander, Executive VP and CIO at The Clearing House.

PYMNTS

DECEMBER 30, 2020

based FI navigated its implementation of the RTP® network and how it strategizes around extending access to its FinTech clients. . That process involves a variety of steps, including working with the RTP API, making changes to internal company processes and thoroughly testing functionalities. Direct Connections .

The Fintech Times

APRIL 8, 2024

The Clearing House also revealed that March became a record month for its real-time payments (RTP) network, boasting over 26 million transactions across the month. RTP network enjoys sustained growth Small businesses also use instant payments to get immediate access to funds through merchant settlement providers utilising the RTP network.

Bank Automation

FEBRUARY 13, 2024

The Federal Reserve’s FedNow payments network, launched nearly seven months ago, has signed up almost as many financial institutions as The Clearing House’s Real Time Payments platform has in seven years.

Fraud.net

SEPTEMBER 27, 2024

How to De-Risk Real-Time Payments (RTP) The post Video: No Time to Lose – AI-Driven Fraud in Real Time Payments (RTP) appeared first on Fraud.net.

Finextra

SEPTEMBER 15, 2024

Real-time payments (RTP) are emerging as a key innovation with the potential to revolutionize how mo.

Finextra

DECEMBER 4, 2024

The Clearing House, the operator of the RTP® network, the largest instant payments system in the United States, will raise the individual transaction limit to $10 million.

Bank Automation

DECEMBER 2, 2024

The instant payments rail, launched seven years […] The post The Clearing House’s RTP clears $500B appeared first on Bank Automation News. Scaling and monitoring growth “is critical when you’re standing up a brand-new network,” Jim Colassano, senior vice president of product development, told Bank Automation News.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content