Why The Coronavirus May Dwarf SARS’ $40B Economic Toll

PYMNTS

JANUARY 28, 2020

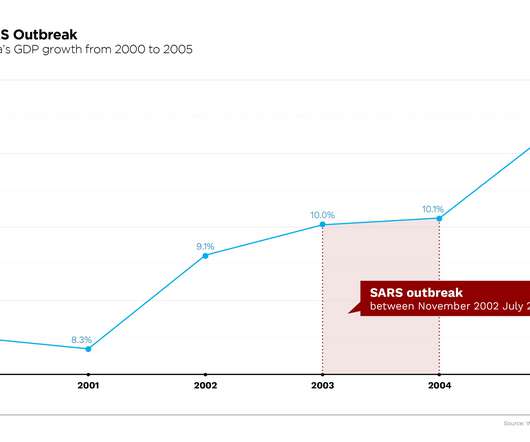

SARS as Prologue? If past is prologue, and history never really repeats itself, but rhymes, there may be some parallels with the SARS outbreak that marked the beginning of the millennium, in 2002 and 2003, and was a viral infection that was also identified as a coronavirus. To be sure, economic growth rebounded quickly, from 2.9

Let's personalize your content